9 Simple Techniques For Hsmb Advisory Llc

9 Simple Techniques For Hsmb Advisory Llc

Blog Article

All about Hsmb Advisory Llc

Table of ContentsThe Main Principles Of Hsmb Advisory Llc Rumored Buzz on Hsmb Advisory LlcNot known Facts About Hsmb Advisory LlcHsmb Advisory Llc Things To Know Before You Get ThisThe Definitive Guide to Hsmb Advisory LlcAn Unbiased View of Hsmb Advisory LlcHsmb Advisory Llc Things To Know Before You Buy

Also realize that some policies can be costly, and having specific health problems when you use can increase the premiums you're asked to pay. Health Insurance. You will require to see to it that you can pay for the premiums as you will certainly require to devote to making these payments if you want your life cover to continue to be in areaIf you really feel life insurance coverage might be useful for you, our partnership with LifeSearch enables you to get a quote from a variety of service providers in dual double-quick time. There are different sorts of life insurance coverage that aim to satisfy various security demands, consisting of level term, lowering term and joint life cover.

Indicators on Hsmb Advisory Llc You Should Know

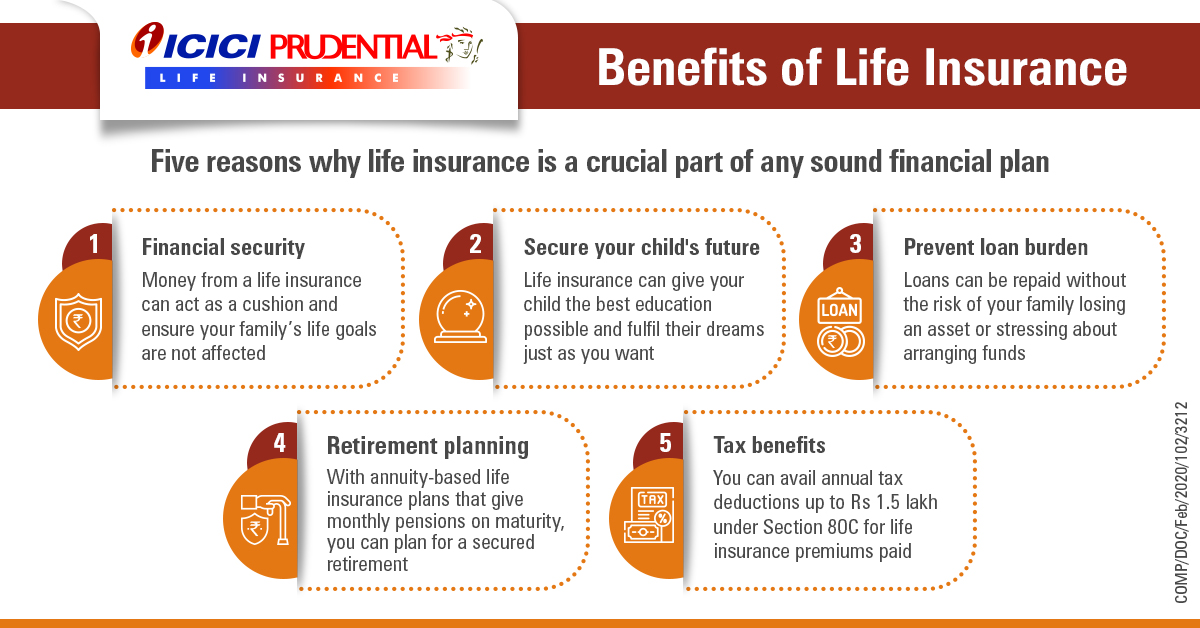

Life insurance policy supplies 5 economic advantages for you and your family (Insurance Advise). The major benefit of including life insurance to your monetary strategy is that if you pass away, your successors obtain a lump sum, tax-free payout from the policy. They can use this money to pay your final expenses and to replace your income

Some plans pay if you establish a chronic/terminal disease and some supply financial savings you can utilize to support your retirement. In this article, discover the numerous advantages of life insurance and why it may be a great concept to invest in it. Life insurance policy provides benefits while you're still active and when you pass away.

Fascination About Hsmb Advisory Llc

If you have a plan (or policies) of that size, individuals that rely on your earnings will still have money to cover their ongoing living expenses. Beneficiaries can use plan advantages to cover important daily costs like lease or home mortgage payments, energy expenses, and grocery stores. Average annual expenses for households in 2022 were $72,967, according to the Bureau of Labor Stats.

A Biased View of Hsmb Advisory Llc

Additionally, the money value of whole life insurance policy expands tax-deferred. As the money value constructs up over time, you can use it to cover expenditures, such as purchasing a car or making a down settlement on a home.

If you choose to borrow against your cash worth, the lending is not subject to earnings tax obligation as long as the policy is not given up. The insurance provider, nevertheless, will bill passion on the car loan quantity up see page until you pay it back (https://pagespeed.web.dev/analysis/https-www-hsmbadvisory-com/gkfdu4b91b?form_factor=mobile). Insurer have varying rates of interest on these loans

A Biased View of Hsmb Advisory Llc

8 out of 10 Millennials overstated the price of life insurance policy in a 2022 research study. In reality, the typical expense is more detailed to $200 a year. If you assume buying life insurance policy may be a wise monetary move for you and your household, consider speaking with an economic consultant to adopt it into your monetary strategy.

The five major kinds of life insurance policy are term life, whole life, universal life, variable life, and last expense coverage, also referred to as burial insurance policy. Each kind has different features and benefits. Term is extra cost effective however has an expiry date. Whole life starts out costing a lot more, but can last your whole life if you maintain paying the costs.

Indicators on Hsmb Advisory Llc You Need To Know

Life insurance coverage could likewise cover your home mortgage and provide cash for your household to maintain paying their costs (https://urlscan.io/result/bbbdf37b-6b14-4d49-b945-0c983b38e5a9/). If you have family depending on your revenue, you likely require life insurance policy to support them after you pass away.

Generally, there are two kinds of life insurance policy intends - either term or permanent plans or some combination of both. Life insurance companies supply different forms of term plans and typical life policies along with "rate of interest sensitive" products which have ended up being more prevalent because the 1980's.

Term insurance provides security for a specified amount of time. This duration can be as brief as one year or supply protection for a specific variety of years such as 5, 10, 20 years or to a defined age such as 80 or sometimes as much as the oldest age in the life insurance policy mortality tables.

How Hsmb Advisory Llc can Save You Time, Stress, and Money.

Presently term insurance policy rates are really affordable and amongst the most affordable traditionally seasoned. It should be kept in mind that it is a widely held idea that term insurance policy is the least pricey pure life insurance policy coverage readily available. One requires to examine the policy terms meticulously to decide which term life alternatives appropriate to meet your specific conditions.

With each new term the premium is boosted. The right to renew the policy without proof of insurability is an essential advantage to you. Otherwise, the risk you take is that your wellness might deteriorate and you may be incapable to obtain a plan at the very same prices or also in any way, leaving you and your recipients without coverage.

Report this page